are delinquent property taxes public record

Delinquent Property Taxes. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

Frequently Asked Questions Property Taxes City Of Courtenay

2 0 2 3.

. Visit Our Official Website Today. Delinquent Property Tax Timeline Author. Property Tax 101 An overview of the Illinois Property Tax system operating in Cook County.

The specifics about each countys sale along with a listing of each certificate of delinquency are required to be advertised in the local newspaper at least 30 days prior to the tax sale date. Payable to Bay County. Delinquent tax records are handled differently by state.

The county appraiser values the property and the county clerk sets the tax levy and computes the tax amount due. You may also call 617-887-6400 for additional information. You may request a price quote for state-held tax delinquent property by submitting an electronic application.

Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. Annual property tax bills are mailed every year in October to the owner of record as of January 1 of that year. Property tax is delinquent on April 1 and is subject to penalties and interest.

Note the original bill may still have the prior owners name on it the first year. 507 Vermont St Suite G12 Quincy IL 62301. Tax FAQs and Glossary of Tax Terms Frequently asked tax-related questions and a glossary of tax terms to know in order to understand your.

Bexar county courts and government offices Note. Once you receive the certified document from our office you can then make an appointment with the Register of Deeds to record the document or mail the certified document to them. Once your price quote is processed it will be emailed to you.

D E L I N Q U E N C Y. Harrison Township Treasurer 38151 Lanse Creuse Street Harrison MI 48045 586-466-1440 Directions. 105-3651 b 1.

Phone 217277-2245 Fax 217277-2000. Travis County Tax Office Website The Tax Office collects fees for a variety of state and local government agencies and proudly registers voters in Travis County. The Milwaukee County Treasurers online inquiry and payment system allows customers to search view.

Only as a last resort do we conduct public auctions to sell the taxpayers interest in the delinquent property for unpaid taxes. For questions visit Frequently Asked Questions Regarding DOR Collections. Macomb County Treasurers Office 1 South Main Street Mount Clemens MI 48043 810-469-5194 Directions.

1 2 0 2 2. Delinquent property tax cannot be paid online. Delinquent property tax auctions resume in three.

If left unpaid the liens are sold at auctions to the public. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. Learn more about delinquent payment plans and how to apply.

Enter Any Address and Find The Information You Need. Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates. Your remittance must be postmarked no later than the 10th calendar day.

The Delinquent Property Tax Bureau monitors the performance of installment agreements until the obligation is paid. The Cook County Clerks office maintains delinquent tax records tax maps information regarding TIF districts. Milwaukee County contracts with Point Pay to offer online payment of delinquent property taxes and fees.

The Tax Office accepts full and partial payment of property taxes online. No need to enter the dashes. The Clerks office also provides calculations of delinquent taxes owed.

Have not paid their taxes for at least 6 months from the day their taxes were assessed. Eventually the lien owners may have to force foreclosure on the property to pay the liens. O n O c t.

The Payment Assistance Grants for Delinquent Property Taxes is a federal program that Uresti says he is working with Congressman Joaquin Castro to make sure Bexar County residents qualify. View Adams County Sheriff foreclosure sale properties by date including case number defendant and address. If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill.

When delinquent or unpaid taxes are sold by the Cook County Treasurers office at an annual sale or scavenger sale the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount necessary to redeem pay your taxes and remove the threat of losing your property. This affects the ability to display the 2021 tax payments on our website. This amount must be obtained by contacting the Treasurers office PRIOR to payment.

At that point you could take possession of. For real estate property. Property taxpayers may use credit cards debit cards or e-Checks to pay their taxes.

All payments received may not be shown as of this date. The county treasurer mails out tax statements to the owner of record on or after the first of November of each year and is responsible for collecting the taxes due including any special assessments and fees. The Clerks office also provides calculations of.

Typically a tax lien is placed on the property by the government when the owner fails to pay the property taxes. You are given 10 calendar days from the date on the price quote to remit your payment. Point Pay charges 239 of the total amount as a convenience fee for credit or debit card charges and a flat fee of 150 for e-checks.

J a n. For addresses enter your Street Number and Street Name. The certificates of delinquency are also listed on the county clerks website at least 30 days prior to the sale.

Postmark date is not proof of payment once a tax is delinquent. This page primarily lists records kept at the county level Uzomba. Delinquent Property Tax Search.

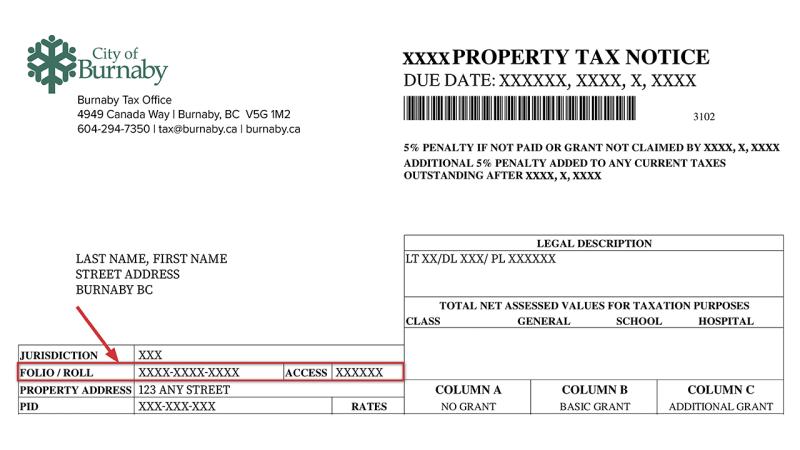

The entire Property Control Number must be entered to perform a Property Control Number search. All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions. The Property Control Number can found on your tax bill.

A prior owner who was not the record owner as of January 6 may not be held personally responsible for taxes on the real property in question. If you have delinquent taxes due you will receive your uncertified document back with your check and a tax statement showing the delinquent taxes due. Whats more the tax office must advertise delinquent tax liens in the name of the January 6 record owners and not in the name of prior owners.

If a certificate of delinquency is sold to a third party purchaser the property owner. Get Property Records from 6 Treasurer Tax Collector Offices in Macomb County MI. If you need confirmation of the 2021 payment please email your request to taxdepartmentseminolecountytax including your name parcel or tax bill number and the address of the property.

Tax notices must be issued in the name of the owner of record as the property stood on January 1 of the taxing year. Delinquent payments must be received on or before the last working day of the month to be considered paid in that month. Department launches new public records portal.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. An additional 30 fee will be added to all real property bills and an additional 40 fee will be added to all mobile home bills if the taxes penalties and assessment fees are not paid by 500 PM on Friday April 22 2022. You may also contact us directly at 407-665-7636.

Learn how you can pay your property taxes.

Secured Property Taxes Treasurer Tax Collector

11 Things You Need To Know About Property Tax 2022

Unsecured Property Tax Los Angeles County Property Tax Portal

Secured Property Taxes Treasurer Tax Collector

P E I Auditor General Flags Tardiness In Property Tax Sales Write Offs Of Unpayable Debt Saltwire

6 Things To Know About Property Titles

Frequently Asked Questions Property Taxes City Of Courtenay

P E I Auditor General Flags Tardiness In Property Tax Sales Write Offs Of Unpayable Debt Saltwire

How To Find Tax Delinquent Properties In Your Area Rethority

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

Property Taxes Town Of Gibsons